- How to do a ledger t account serial number#

- How to do a ledger t account trial#

Liability Accounts – Bank Loans, payables, taxes, etc. Asset Accounts – cash, inventory, accounts receivable, etc. Each account can then be categorized under one of these. There are three types of balance sheet ledger account categories. Balance Sheet and Income Statement Ledger AccountsĪnother way of categorizing ledger accounts is to record them as balance sheet or income statement accounts.

Instead, they summarize it under the owner’s equity heading. For instance, small businesses do not use stock accounts. The types of ledger accounts can differ by the nature and size of a business.

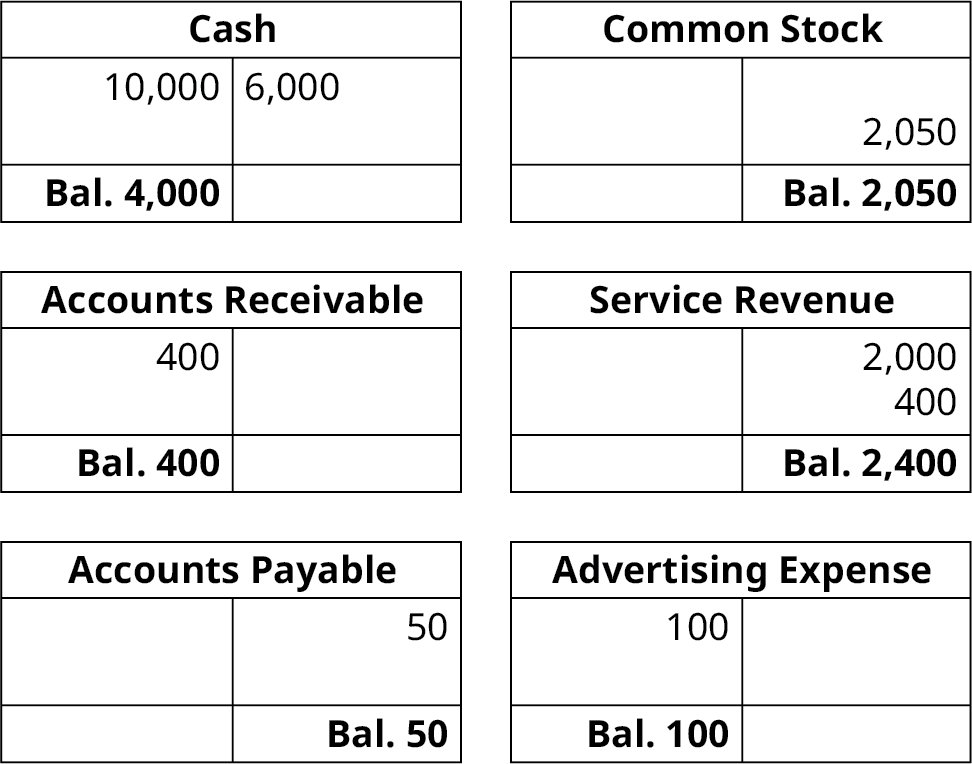

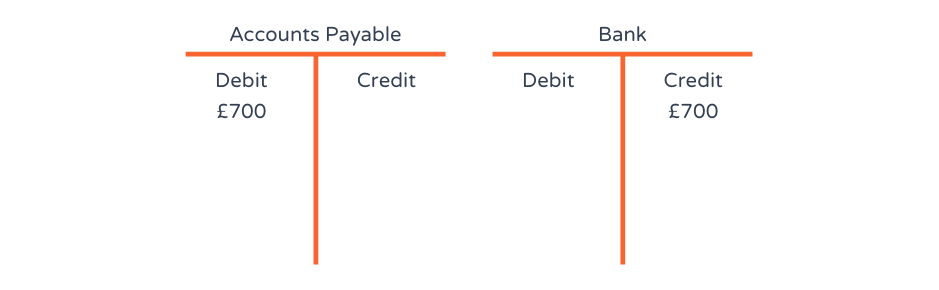

Expenses: Examples of expense accounts include rent, utilities, marketing, admin, and selling expenses. Revenue: These accounts include any revenue stream of a business including sales, commission, interest income, and royalties. Equity: equity accounts can be categorized into common stocks, preferred stocks, additional paid-in capital (or share premium), and retained earnings of a business. Liabilities: liability accounts can be accounts payable, bank loans, mortgages, payroll, and taxes, to name a few. Asset accounts include cash, inventory, property, equipment, goodwill, trademark, and so on.  Assets: asset accounts can be further classified into several categories such as fixed assets, current assets, tangibles, and intangibles. Each type of business transaction can be categorized as a new type.īroadly, a business can have the following types of ledger accounts: Related article Accounting Materials and Office Supplies (Definition, Explanation and Journal Entries) Types of Ledger AccountĪ business can list ledger accounts for several categories.

Assets: asset accounts can be further classified into several categories such as fixed assets, current assets, tangibles, and intangibles. Each type of business transaction can be categorized as a new type.īroadly, a business can have the following types of ledger accounts: Related article Accounting Materials and Office Supplies (Definition, Explanation and Journal Entries) Types of Ledger AccountĪ business can list ledger accounts for several categories. How to do a ledger t account trial#

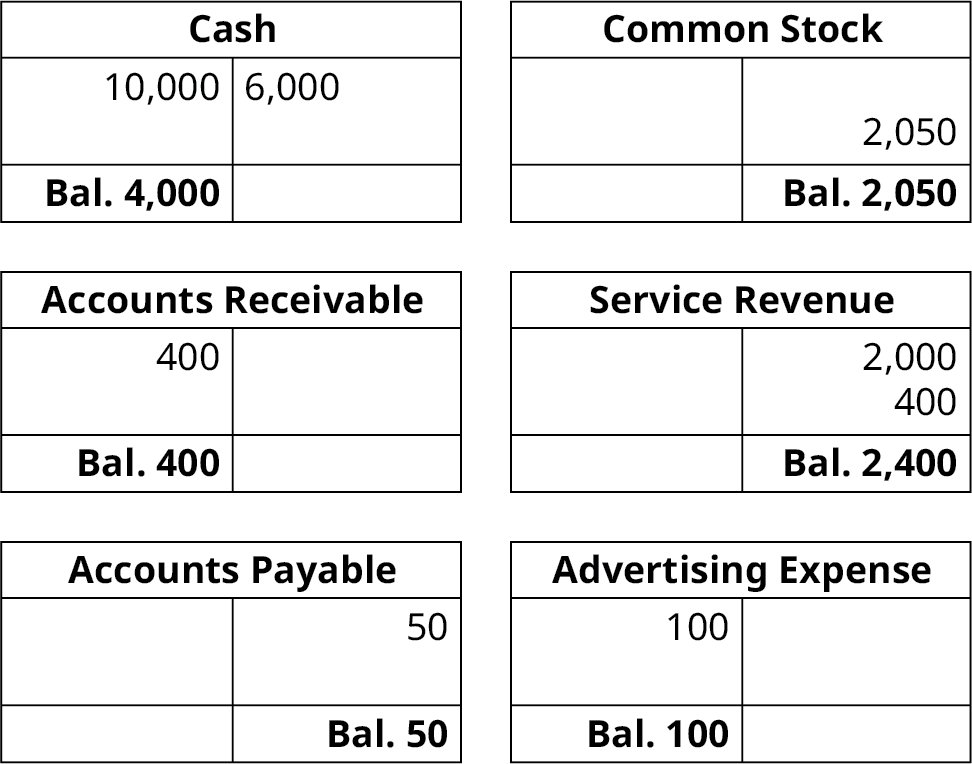

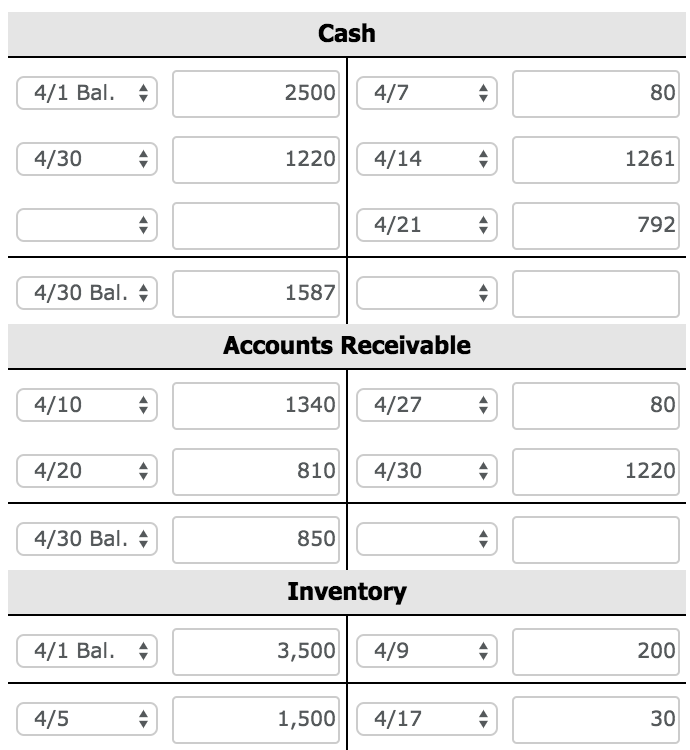

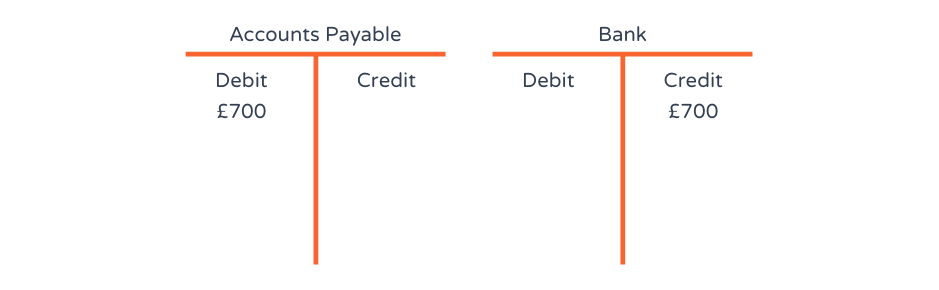

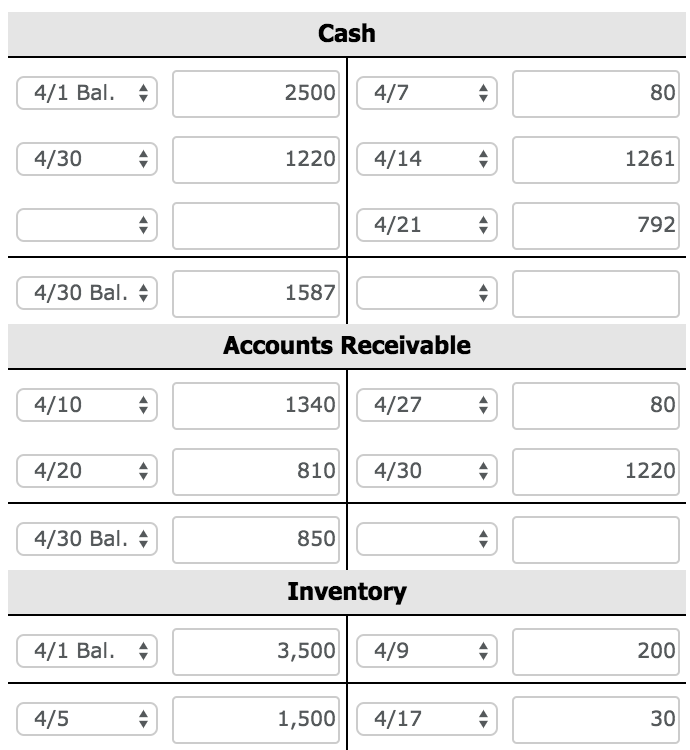

These figures are then carried forward to the trial balances that are used to create financial statement accounts. The debit and credit balances for each account must balance at any given time. Each transaction adds/reduces the balance and at the end of the accounting period, it shows the ending balance.

Account Balance – Each account begins with an opening balance. Each transaction has an offsetting entry for a debit and a credit. Debit and Credit columns of the account.  A general description or detail of the transaction.

A general description or detail of the transaction. How to do a ledger t account serial number#

It can be a simple serial number that can be reset after each accounting period.

A Journal Entry or the transaction number of an entry under each ledger account. For instance, a typical ledger account follows a T account format.Ī typical ledger account will have the following components: Ledger Account FormatĪ ledger account can be presented in different ways. In other words, it presents the summary of each type of transaction or a particular category for the business. Each account records all relevant transactions.Ī ledger account would reflect the accumulated balance of all transactions carried out in a specific accounting period. Individual ledger accounts are then presented in the general ledger that is also called the book of accounts for business. Each ledger account presents the trial balance at any given time. What is a Ledger Account?Ī ledger account is the record of transactions related to a particular segment of the business. Let us discuss the definition and types of ledger accounts with the help of an example. A business can have five types of ledger accounts: assets, liabilities, equity, revenue, and expense. A general ledger is the collection of these ledger accounts. Ledger accounts are the accounting units that present the summarized balances of transactions under each category.

0 kommentar(er)

0 kommentar(er)